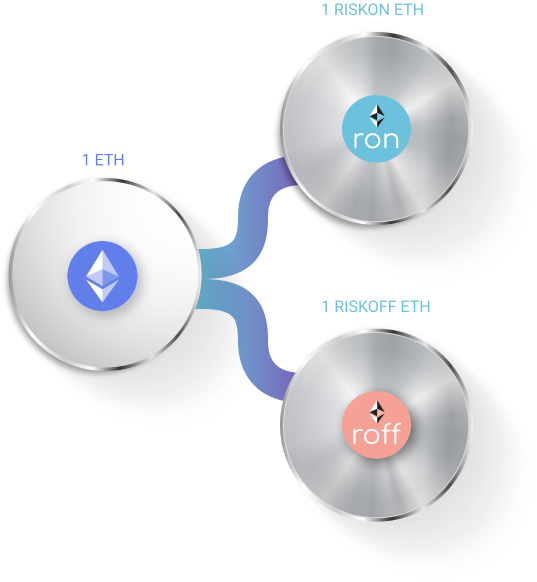

Levered exposure to ETH with no margin calls & no

liquidations

Specs:

- Long 50% of 1 ETH

- Short put at strike = 95% of starting price

- Long call at strike that makes value of put and call equivalent

- Monthly settlement

- Perpetual

Lower volatility and beta relative to ETH with limited

downside

Specs:

- Long 50% of 1 ETH

- Long put at strike = 95% of starting price

- Short Call at strike that makes value of put and call equivalent

- Monthly settlement

- Perpetual

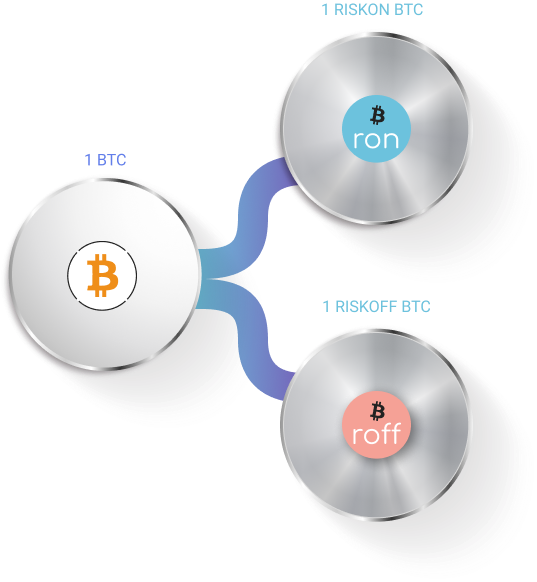

Levered exposure to BTC with no margin calls & no liquidations

Specs:

- Long 50% of 1 BTC

- Short put at strike = 90% of starting price

- Long call at strike that makes value of put and call equivalent

- Quarterly settlement

- Perpetual

Lower volatility and beta relative to BTC with limited

downside

Specs:

- Long 50% of 1 BTC

- Long put at strike = 90% of starting price

- Short call at strike that makes value of put and call equivalent

- Quarterly settlement

- Perpetual